GET CERTIFIED

THE CERTIFICATION PROCESS

Clarity. Confidence. Commitment. The path to FLP ™ certification is a rewarding process that gives you the knowledge and skills you need to grow your business.

THE FINANCIAL LIFE PROFESSIONAL™ CERTIFICATION REQUIREMENTS

Our easy 4 step process to provide comprehensive Financial Life Planning™ to your clients, so you can help them achieve confidence today and a clearer picture of tomorrow.

THE EDUCATION REQUIREMENT

The education requirement involves (1) completing the curriculum on Financial Life™ planning through the FLP™ online portal , OR (2) attending an in-person LIVE FLP™ Quickstart event instructed by one of our leading FLP™ instructors.

You must complete the coursework before you can take any module quizzes.

QUICK FACTS

Average time to complete the coursework is 240 minutes.

MODULE QUIZ REQUIREMENT

You must demonstrate you’ve attained the knowledge and competency necessary to provide comprehensive personal Financial Life Planning™. Each module contains multiple-choice questions that show you’ve retained a level of understanding of how to use the material.

QUICK FACTS

You must complete the quizzes in order to advance and understand how to use the material to stay top of mind with your clients.

THE LIVING DEMONSTRATION REQUIREMENT

You must complete our capstone which ultimately means you become a living embodiment of the principles you preach, applying assessment tools, planning strategies, and organizational materials to your own Financial Life™ before assisting clients. This hands-on experience helps you master the tools, set realistic expectations based on your outcomes, and clearly communicate the benefits to your clients.

QUICK FACTS

Our capstone must be completed or in the process of being completed it in order to obtain your certificate of completion.

THE CODE OF ETHICS REQUIREMENT

The requirement is the final step on your path to FLP™ certification. It indicates you’ve agreed to adhere to high ethical and professional standards for the practice of Financial Life™ Planning, and to act in your client’s best interest when providing Financial Life™ Planning to your client, always putting their best interests first.

QUICK FACTS

You’ll need to sign the Code of Conduct Declaration and yearly participation agreement.

WE’RE HERE TO HELP

Our current FLP’s offer the guidance, real-world advise, tools and support you need to successfully become a Financial Life Professional™, no matter what stage of the process you’re in. Connect with other FLP’s. Whether you have a question, need advice or are just looking for support, we welcome you to connect with us.

Meet our FLP’s

I’M A CAREER CHANGER

“I have a 4-year college degree and am working at a job I don’t love. Looking for a new start.”

I’M A FINANCIAL PROFESSIONAL

“I have a degree and 3 years of experience as a financial professional. It’s time to fast-track my career.”

I’M A STUDENT

“I’m a college student looking to pursue a career in financial planning.”

EARN 4-YEAR DEGREE

A bachelor's degree in any discipline is required. You can earn your degree up to 5 years after passing the CFP® exam.

COMPLETE CFP® CERTIFICATION COURSEWORK

You must complete the certification coursework through a CFP Board Registered Program before you can take the CFP® exam.

PASS CFP® EXAM

Don't forget that you must complete your certification coursework through a CFP Board Registered Program before you can sit for the CFP® exam.

ACCUMULATE EXPERIENCE

You can fulfill the experience requirement either before or after you take the CFP® exam.

MEET ETHICS REQUIREMENT

You must sign an Ethics Declaration, and undergo a background check.

EARN CFP® CERTIFICATION

Congrats on your grit and determination! You've achieved the standard of excellence and can now use the CFP® marks to market yourself.

YOUR EDUCATION AND EXPERIENCE MAY QUALIFY YOU TO GET A JUMPSTART ON YOUR CERTIFICATION.

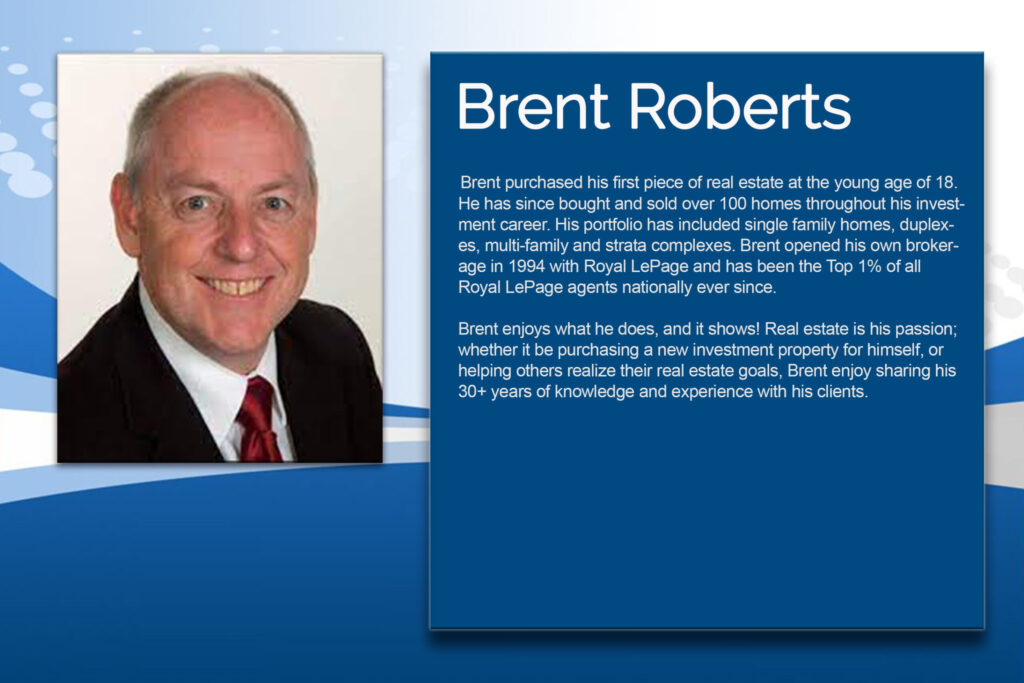

Brent opened his own brokerage in 1994 with Royal LePage and has been the Top 1% of all Royal LePage agents nationally ever since. Brent enjoys what he does, and it shows! Real estate is his passion; whether it be purchasing a new investment property for himself, or helping others realize their real estate goals, Brent enjoy sharing his 30+ years of knowledge and experience with his clients.

During that time, Kyle also became a real estate agent, using his knowledge and expertise to help clients find their dream home or investment property. Kyle has been able to help his clients buy and sell multi-million dollar homes, condos and investment properties. As well, Kyle has successfully managed a project portfolio of over 275 million dollars and has been able to bring this vast amount of experience to his real estate portfolio. This has catalyzed him to adopt processes and checklists to help manage his tenants (clients) which has taught him to treat his real estate investing portfolio like a business.

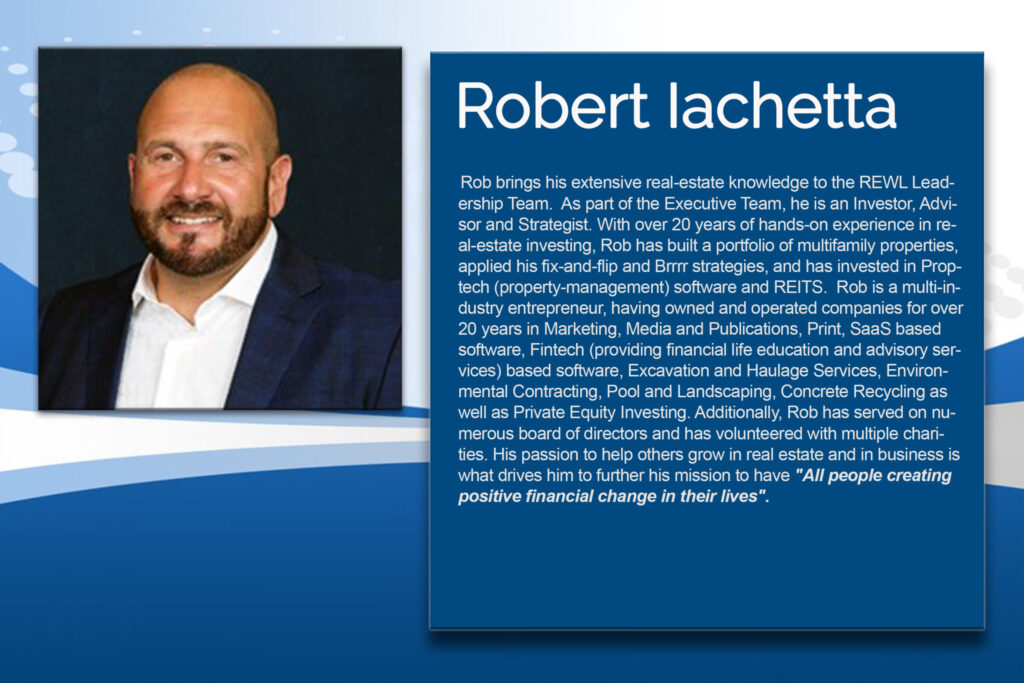

Rob is a multi-industry entrepreneur, having owned and operated companies for over 20 years in Marketing, Media and Publications, Print, SaaS based software, Fintech (providing financial life education and advisory services) based software, Excavation and Haulage Services, Environmental Contracting, Pool and Landscaping, Concrete Recycling as well as Private Equity Investing. Additionally, Rob has served on numerous board of directors and has volunteered with multiple charities. His passion to help others grow in real estate and in business is what drives him to further his mission to have "All people creating positive financial change in their lives".

Jessilyn takes complex, often confusing topics of wealth and worth and breaks it down into immediately useful and digestible ways for women to improve their relationship with money. This soon-to-be author has the insights and hard-earned wisdom that comes only from real-world experiences: "At one point I was dealing with workplace harassment, building a side business, and raising my two young boys. I was deeply unhappy. I knew something needed to change".

By using her strong prowess of leadership, expertise in financial education and real estate investing, she educates and supports women to create a vision and a plan that can transform their life. "I want women to have a life full of abundance, and that starts with their relationship to money, wealth, and worth".

Keith has expanded his knowledge through meetings, courses, and networking as a member of the Real Estate Investment Network (REIN) since 2011. He has completed live presentations and has had several featured articles. Additionally, Keith has been a basketball official for 30 years and officiated at the 2017 Invictus Games in Toronto.

AWARDS: 2017 REIN Real Estate Professional of the Year, 2017 Mortgage Alliance: Top 20% Canada, 2015 REIN Innovative Investor of the Year.

Keith's vision is that "Everyone Shall Live a Life of Abundance." His passion for being a Real Estate Investment Advisor and Mortgage Agent stems from his ability to find impactful ways to help others achieve their short-term and long-term goals.

In 2018, Tarah decided to branch out and help more people create and achieve their dreams by becoming a licensed Realtor with Royal LePage Gateway Realty and a licensed Real Estate Investment Advisor with LEGACY. By broadening her skills, she aims to help more people gain more free time and generate more income for whatever they want to achieve in life. Together, she believes, anything is possible.

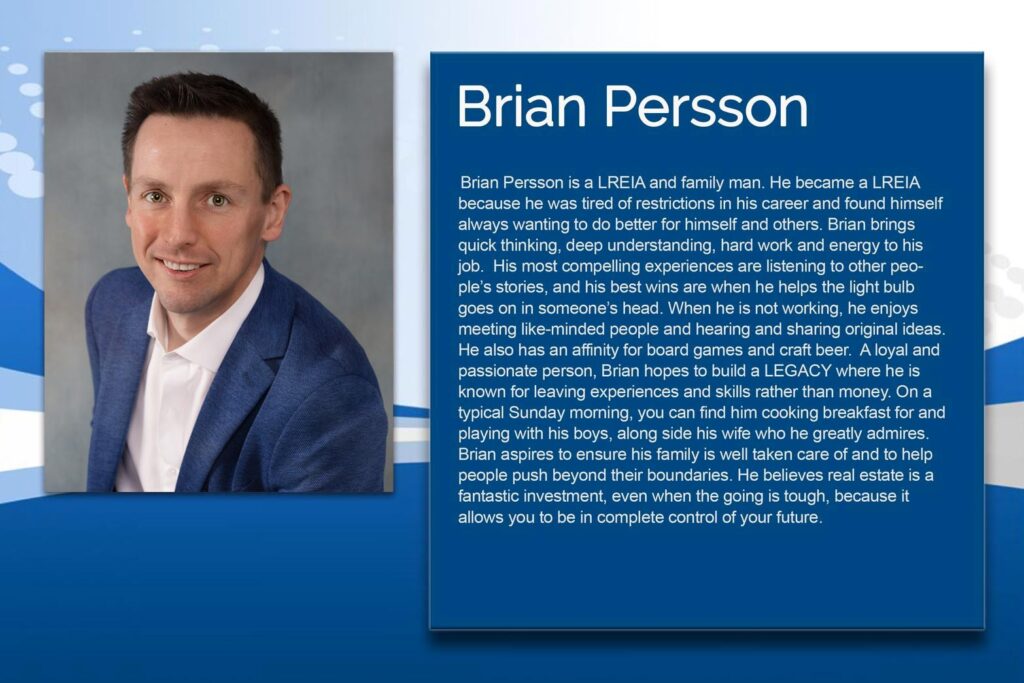

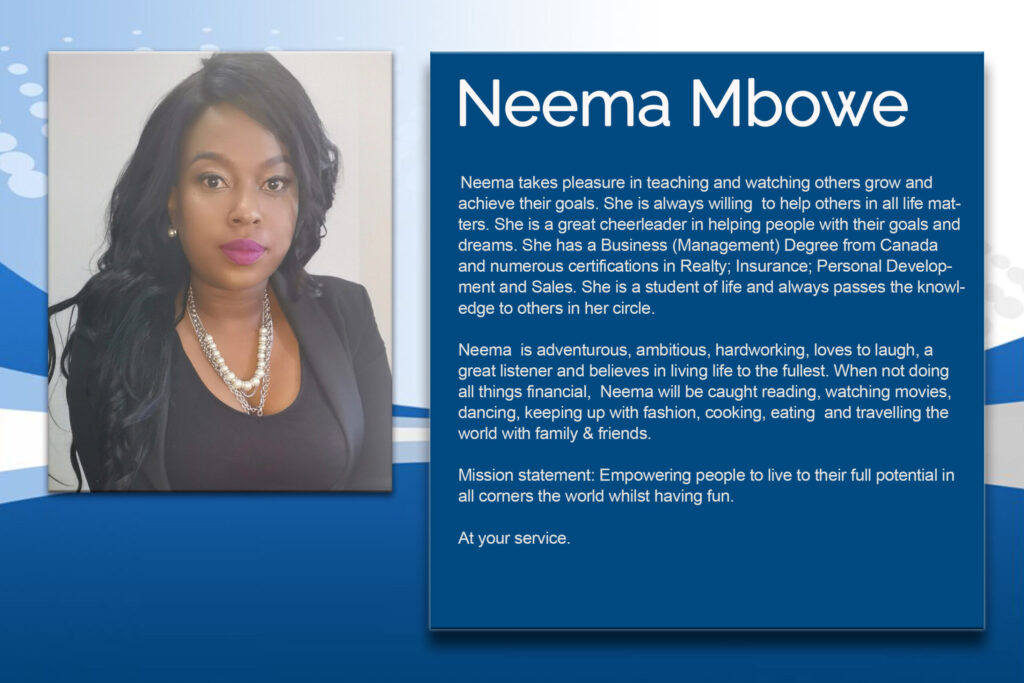

Neema is adventurous, ambitious, hardworking, loves to laugh, a great listener and believes in living life to the fullest. When not doing all things financial, Neema will be caught reading, watching movies, dancing, keeping up with fashion, cooking, eating and travelling the world with family & friends.

Mission statement: Empowering people to live to their full potential in all corners the world whilst having fun.

A man of multiple talents, a leader who loves to dwell in the intersection of business and living a meaningful life, Niran's story is fascinating and inspiring. After a serious motorcycle accident altered his life and career path, he and his family faced some very tough choices. A gifted speaker and person-to-person communicator, as well as an entrepreneur, he began a path that would lead him to transformational success. Through a combination of savvy real estate investment strategies and personal coaching/consulting, Niran quickly solidified a new career path and built a reputation among his peers in the real estate investment world.

WE’RE HERE TO HELP

CFP Board offers the guidance, tools and support you need to successfully become a CFP® professional, no matter what stage of the process you’re in. Watch this video to see how CFP Board can support you.

PEERS AND MOTIVATION

Use our candidate forum to connect with others who are at various stages on their path to CFP® certification. Whether you have a question, need advice or are just looking for support, we welcome you to join in.

Exam Preparation

Learn about what's on the CFP® exam, take practice exams with real questions from past exams and get tips on how to be ready for exam day.

GUIDANCE AND MENTORSHIP

Find a CFP® professional mentor who can offer real-world advice, help you stay motivated and guide you on your path to CFP® certification.

FINANCIAL AID

To diversify the financial planning workforce, the CFP Board Center for Financial Planning offers scholarships for coursework and for the CFP® exam.

ADD THE FINANCIAL LIFE PROFESSIONAL™ CERTIFICATE TO YOUR BUSINESS

- Get Started Online or Attend A Quickstart

- Complete Courseware and Requirements

- Get Your Certificate

- Get Access To The Assets

- Reach Out & Connect With Your Clients

- Use the Tools With Your Clients

- Be of Value & Service To Them

- Watch Your Business Grow

99 Scollard Street Suite 600

Yorkville Toronto ON M5R 1G4

1.226.917.4247

FOLLOW